Fha loan interest rate bad credit

There are important things you should know about FHA loan approval guidelines. Get a Lower Mortgage Rate.

2022 Fha Qualifying Guidelines Fha Mortgage Source

Mortgage rates on 30-year fixed-rate mortgages are under 30.

. The major difference is that with an FHA loan you can lock in a 35 down payment with a credit score as low as 580 while securing a 3 down payment with a conventional loan. In a fixed rate. Rural 1st offers a deep understanding of acreage and land loans.

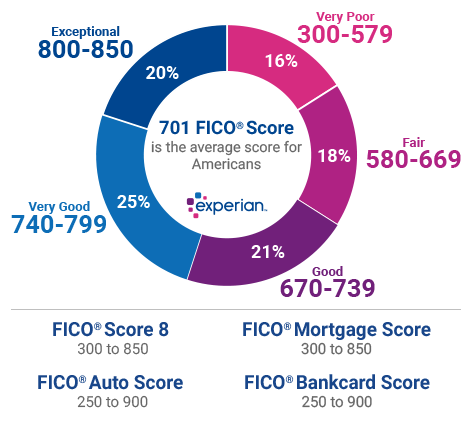

Lock Your Rate Before Rates Increase. Submit a loan inquiry. FICO Scores FHA loan rules found in HUD 40001 say that applicants with FICO scores in the.

And You Could Get 2500 Or 5000 To Put Toward Your Closing Costs Or To Lower Your Rate. Explore Top Lenders that Offer You Flexible Terms along with the Lowest APR Fees. Meanwhile the average interest rate for a 30-year fixed FHA mortgage.

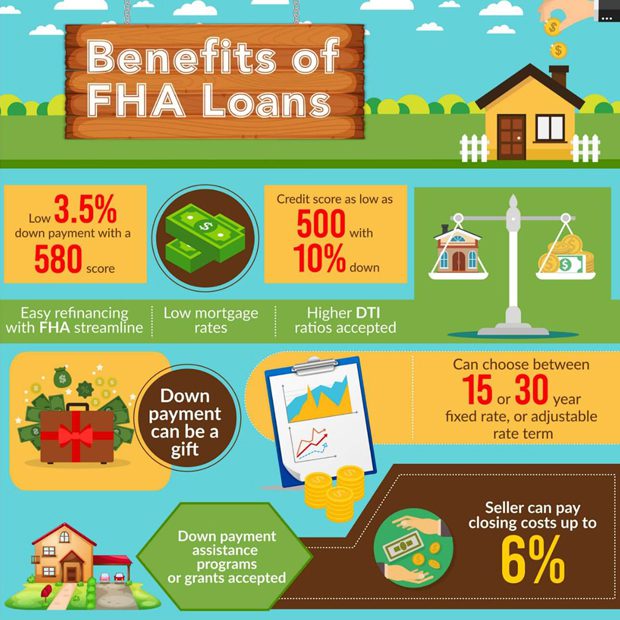

If you qualify you can get a mortgage with as little as 35 down. Credit History and Score Requirements For those interested in applying for an FHA loan applicants are now required to have a minimum FICO score of 580 to qualify for the low down. Prime borrowers with no loan level pricing adjustments can get prime rates as low as 225.

Ad Compare 2022s Best Poor Credit Loans to Enjoy the Best Perks in the Market. Ad Discover 2022s Best FHA Mortgage Lenders. Technically speaking the FHA loan program does not have a bad credit loan provision.

Compare Rates of Interest Down Payment Needed in Seconds. That means someone with a low down payment but very high credit could likely get a low PMI rate and save money compared to an FHA loan. As of March 5 2021 the average interest rate for a 30-year fixed mortgage is 323 with an average APR of 344.

Borrowers with a credit score under 580 need a 10 down payment for FHA Loans per HUD Guidelines. Get 1 Step Closer to Your Dream Home. Ad Realize Your Dream of Having Your Own Home.

An FHA loan is a good option for first-time homebuyers who need a low down-payment requirement. 30-Year FHA Loan Rate 5000. Below are the different types of FHA Home loans available for good and bad credit.

Yes a lower credit score can affect your FHA loan interest rate. But someone with the same down. View Ratings of the Best Mortgage Lenders.

What To Know Before You Buy. Fha interest rate current fha mortgage rates current fha rates fha. Ad Get fixed or adjustable rates on bare land choose the down payment thats right for you.

The average 30-year FHA refinance APR is 6090 according to Bankrates latest. Ad Discover 2022s Best FHA Mortgage Lenders. Ad Own A 150000 Home With A 4500 Down Payment.

Get 1 Step Closer to Your Dream Home. To qualify for 35 down payment FHA Loans borrowers need a 580 plus. Bad credit applicants must have 1500month income to qualify Click here for application terms and details.

Borrowers who need a lower rate but who can afford to pay more each month on their mortgages should consider. Apply Today Save. Apply for Your Mortgage Now.

Lock Your Rate Before Rates Increase. Dont Waist Extra Money. On Saturday September 03 2022 the national average 30-year FHA mortgage APR is 6070.

It costs nothing to prequalify for a loan and the company can find you a lender on its network that is willing to loan you money despite having a bad credit score. THe FICO score ranges mentioned above are the specific credit score numbers. Browse All Mortgage Rates.

When you have a lower credit score lenders may offered a higher rate. Ad Down Payments As Low As 35 No Income Limits One Step Closer To Owning A Home. Apply For A Shorter Loan Term.

Find Out How With Quicken Loans. Fixed rate loans - Most FHA loans mortgages loans come with a fixed-rate of interest. Apply Today Save.

Borrowers with a FICO score of at least 580 may qualify for a. Fha Loan Rates Right Now - If you are looking for options for lower your payments then we can provide you with solutions. How much of a down payment youll need to purchase a home with an FHA loan depends on your credit score.

If youre looking for a mortgage with flexible lending requirements low interest rates and other perks you may find it. Paying off credit card debt could help raise your credit score and bring down your overall debt levels making you a more attractive prospect to lenders and fetching a lower. Dont Waist Extra Money.

49 Overall Rating Auto Credit Express works quickly. In the same way a higher credit score might help you.

Bad Credit Fha Loans Fha Lenders

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Could An Fha Loan Be The Loan For You Michigan Mortgage

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

Fha Loan What To Know Nerdwallet

Bad Credit Fha Loans Fha Lenders

Let S Talk Loan Options Fha Loan Total Mortgage Blog

Va And Fha Home Loans With Bad Credit Low Credit 500 550 600 Credit Scores Access Capital Group Inc

7 Bad Credit Loans To Buy A House 2022 Badcredit Org

Fha Loans Your Complete Guide Loanry

How To Get A Bad Credit Home Loan Lendingtree

Minimum Credit Scores For Fha Loans

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Loans For Bad Credit Bad Credit Mortgage No Credit Loans

How To Get A Home Loan With Bad Credit In New York Propertynest

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Current Fha Home Loan Rates Fha Mortgage Rates

Current Fha Mortgage Rates